are campaign contributions tax deductible in 2020

What charitable contributions are tax deductible in 2020. Deduction for excess premium.

Pharma Funded Over 2 400 State Lawmaker Campaigns In 2020

You can obtain these publications free of charge by calling 800-829-3676.

. 2020 Presidential Debate Are personal campaign contributions tax deductible-----The purpose of our channel is to create informational videos. Includes limits that apply to individual. Individuals can elect to deduct donations up to 100 of their 2020 AGI up from 60 previously.

In general you can deduct up to 60 of your adjusted gross income via charitable donations 100 if the gifts are in cash but you may be limited to. Only those donations or contributions that have been utilizedspent during the campaign period as set by the comelec. Corporations may deduct up.

What contributions are tax deductible. The federal contribution limits that apply to contributions made to a federal candidates campaign for the US. What charitable contributions are tax deductible in 2020.

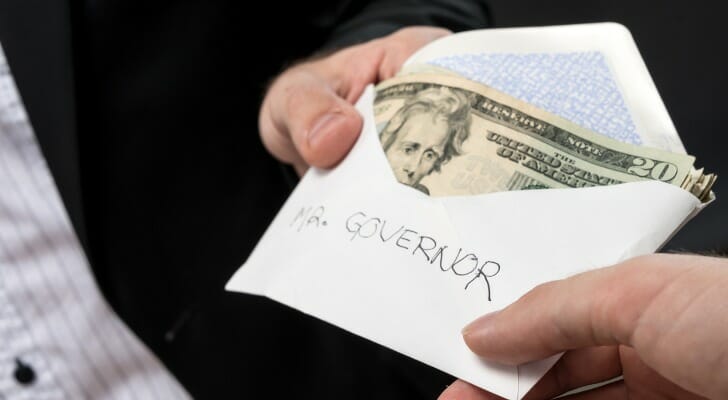

In most states you cant deduct political contributions but four states do allow a tax break for political campaign contributions or donations made to political candidates. Are Campaign Contributions Tax Deductible In 2020. Its only natural to wonder if donations to a political campaign are tax deductible too.

Contributions or donations that benefit a political candidate party or cause are not tax deductible. You will find details on 2020 tax changes and hundreds of interactive links to help you find answers to your questions. Just know that you wont be getting a federal tax break.

You may deduct charitable contributions of money or property made to qualified organizations if you. Corporations may deduct up to 25. These limits apply to all contributions except contributions from a candidates.

You may also be able to access tax. The Federal Election Commission lists the contribution limits for 2019-2020 federal elections. With the 2020 elections behind us and tax-filing season now here you might be wondering whether or not you can deduct political contributions you made last year.

Campaign Funding Explained How Are Political Campaigns Financed Caltech Science Exchange

The Little Red Boxes Making A Mockery Of Campaign Finance Laws The New York Times

:max_bytes(150000):strip_icc()/hard-money-soft-money_final-0223d3d452a049dc95a8a05b20c9142a.png)

Hard Money Vs Soft Money What S The Difference

Campaign Finance Reform In The United States Wikipedia

Give Chi Omega Sorority Chattanooga Tn

States With Tax Credits For Political Campaign Contributions Money

How To Get Your Maximum Tax Refund Credit Com

Giving Campaign 2020 Gwinnett County Alumnae Chapter Delta Sigma Theta Sorority Inc

Are Political Contributions Tax Deductible

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

Are Political Contributions Tax Deductible Smartasset

How Large Are Individual Income Tax Incentives For Charitable Giving Tax Policy Center

Who Pays Income Taxes Foundation National Taxpayers Union

Support Nhef North Hunterdon Education Foundation Nhef

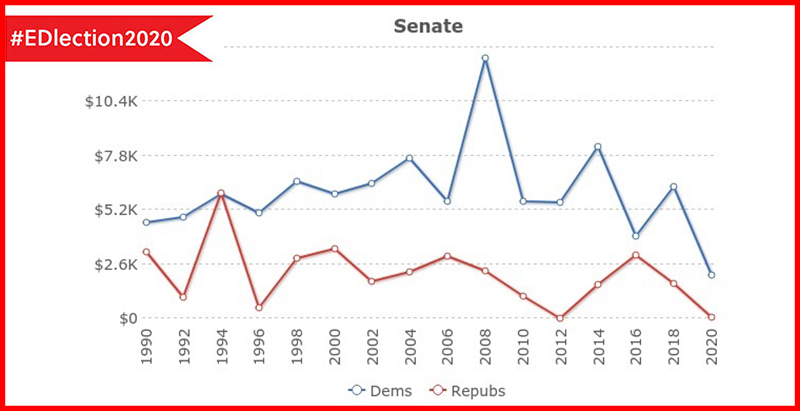

Analysis How Much Nea And Aft Are Spending On The 2020 Campaign And Where They Are Spending It The 74

Stay Out Of My Space 2020 Stay Home Event Sept 15th To Oct 1st Smithtown Democrats