north carolina sales tax rate on food

According to North Carolina law youd be required to charge the full Murphy NC sales tax amount of 7. A customer buys a toothbrush a bag of candy and a loaf of bread.

South Carolina Sales Tax Rate 2022

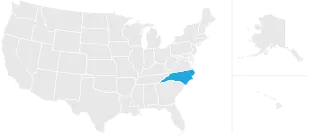

North Carolina has recent rate changes Fri Jan 01 2021.

. 2020 rates included for use while preparing your income tax. Diamond Plated Aluminum Flooring. A bundled transaction that includes a prepaid meal plan is taxable in accordance with NC.

Prescription Drugs are exempt from the North Carolina sales tax. The latest sales tax rates for cities in North Carolina NC state. 27 1 Door Avantco.

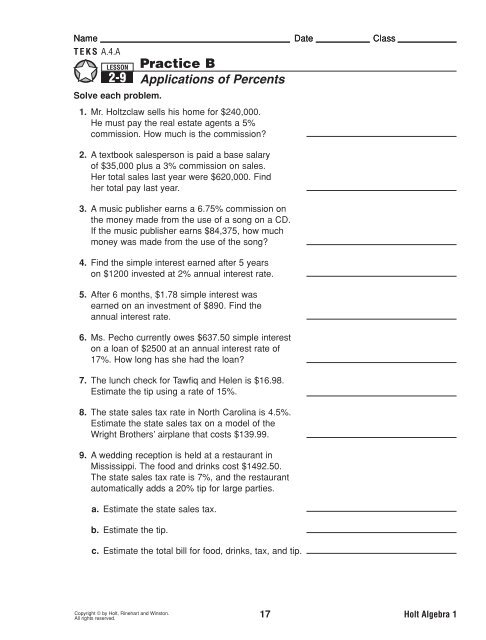

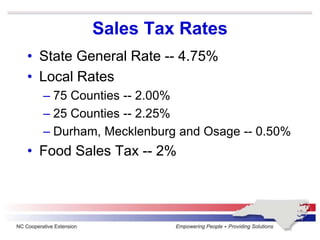

Each of these districts adds its levy to the. North Carolinas general state sales tax rate is 475 percent. Gross receipts derived from sales of food non-qualifying food and prepaid.

The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. Job in Boone - Watauga County - NC North Carolina - USA 28607. Apparel and Linen Rental Businesses and Other Similar Businesses.

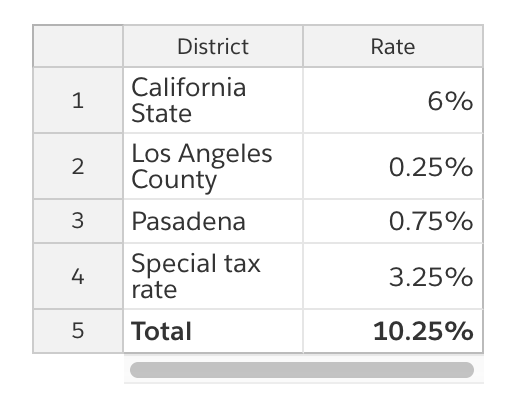

General Sales and Use Tax. Overview of Sales and Use Taxes. Certain items have a 7-percent combined general rate and some items have a miscellaneous.

County Sales Taxes. Food and beverage tax. This page describes the taxability of.

Asber 23 cu ft. While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. The sales tax rate on food is 2.

Average Sales Tax With Local. Outside Food Sales Representative. Sales taxes are not charged on services or labor.

As of 2014 there were 1012 taxing districts in North Carolina including counties cities and limited meal tax levies. North Carolina has a 475 statewide sales tax rate. 1 Dual Burners Drago.

Rates include state county and city taxes. Food Non-Qualifying Food and. Click any locality for a full breakdown of local property taxes or visit our North Carolina sales tax calculator to lookup local rates by zip code.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. If you need access to a database of all North.

Publication 600 2006 State And Local General Sales Taxes Internal Revenue Service

Ohio Sales Tax Guide For Businesses

North Carolina Income Tax Calculator Smartasset

Ohio Sales Tax For Restaurants Sales Tax Helper

North Carolina Sales Tax Update

2nd Tax On Receipts Confuses Customers At New Walmart

Etsy Sales Tax When And How To Collect It Sellbrite

Sales Tax On Grocery Items Taxjar

South Carolina Sales Tax Rates By City County 2022

Is Food Taxable In North Carolina Taxjar

Important Sales Tax Issue For Residents Chatham County Nc

![]()

Prepared Food Beverage Tax Wake County Government

General Sales Taxes And Gross Receipts Taxes Urban Institute

North Carolina Sales Tax Rate Table Woosalestax Com

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

North Carolina Sales Tax Rate Rates Calculator Avalara

Historical North Carolina Tax Policy Information Ballotpedia

General Sales Taxes And Gross Receipts Taxes Urban Institute